Transform Insurance Operations with Smart Software

Our insurance software development services enable insurers to automate critical processes, enhance data protection, and integrate advanced technologies. From claims management to customer engagement, we help your organization achieve efficiency, transparency, and growth. Our expert team designs scalable, user-friendly solutions tailored to your business model — empowering you to minimize operational costs, reduce manual errors, and deliver superior customer experiences. Whether you’re modernizing legacy systems or building a new digital platform from the ground up, we ensure seamless integration, regulatory compliance, and long-term reliability.

- Automate critical insurance workflows

- Enhance data protection

- Integrate advanced technologies

- Deliver superior customer experiences

- Modernize legacy systems

Smart Insurance Solutions for the Digital Era

Transform your insurance operations with intelligent software that automates workflows, secures data, and keeps your business ahead through innovation.

Insurance Software Development

Creating next-generation insurance solutions from the ground up — built to scale, perform flawlessly, and deliver maximum value at minimal cost.

Share your idea →Insurance Software Modernization

Transforming legacy insurance platforms to meet evolving industry benchmarks for secure, user-friendly, and interoperable solutions.

Leave a request →UI/UX Design

Deep exploration of user interactions, motivations, and aesthetic preferences to craft intuitive, engaging experiences.

Order an estimate →Third Party Integrations

Empowering insurance enterprises to modernize through seamless integration of intelligent automation into existing legacy infrastructures.

Get a consultation →

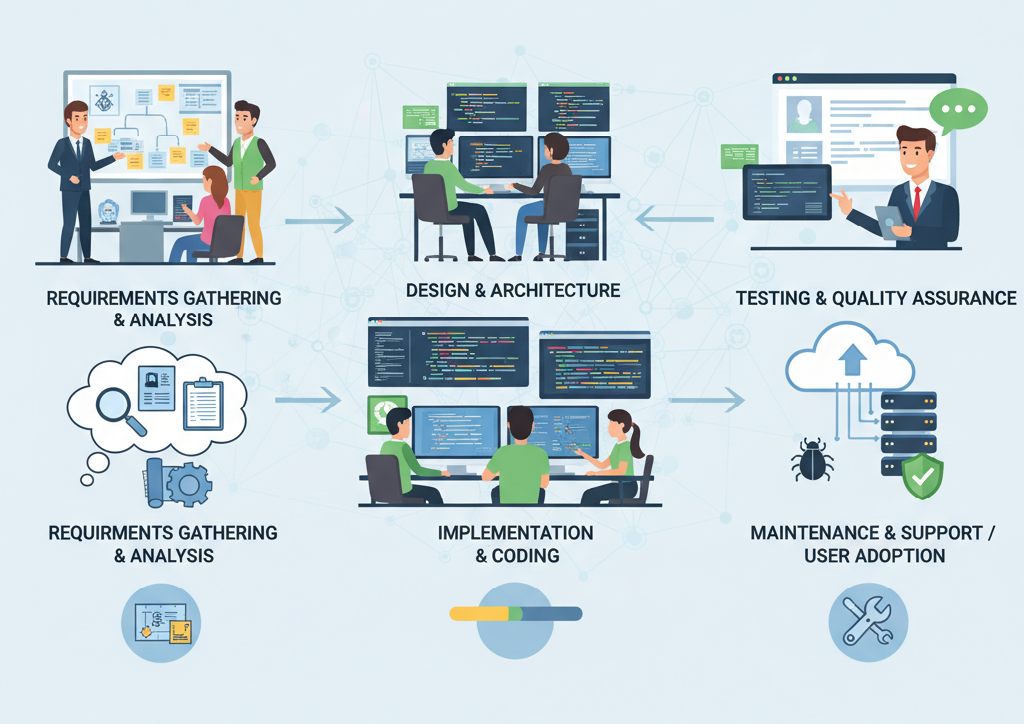

Our insurance software development process is designed to deliver secure, efficient, and future-ready solutions tailored to your business needs. We begin with a detailed analysis of your requirements and workflows, followed by strategic planning and architecture design. Our team then develops scalable software that automates key insurance operations, enhances data protection, and integrates advanced technologies like AI and analytics. Rigorous testing ensures performance, reliability, and compliance with industry standards.

Insurance Software Tech Advantage:

- AI-Powered Automation

- Enhanced Data Security

- Cloud Integration & Scalability

- Advanced Analytics & Insights

Core industry expertise

For over a decade, we’ve specialized in crafting advanced web platforms, mobile applications, and complex systems aligned with emerging trends.

Healthcare

- EHR, EMR, Patient Portal

- Telemedicine

- Patient Monitoring

Supply Chain

- Warehouse Tech

- Last Mile Delivery

- Freight Tech

Finance

- Banking, Investment

- Insurance, Policy & Claims

- Blockchain in FinTech

Marketplace

- Versatile Business Models B2C, B2B, C2C, and P2P

- Multi-Vendor Ecosystem

- Market Network & Services Hub

Retail

- CRM for customer relationship management.

- POS systems for smooth transactions.

- RMS and similar tools for store & chain operations.

Media

- Streaming solutions for mobile, desktop, and TV.

- Entertainment software for diverse platforms.

- Seamless cross-device viewing experiences.

Education

- LMS for efficient learning.

- AR/VR for immersive training.

- Digital tools for teaching & learning.

Travel

- Easy booking systems.

- HMS for hospitality.

- TMS for travel planning.

Social

- Custom business platforms.

- Features to boost engagement.

- Scalable, future-ready solutions.

Ready to enhance your insurance operations?

Let automation simplify your insurance operations. Tell us what you need, and we’ll craft the perfect solution to meet your goals.

Transforming Insurance with Smart Software Solutions

We specialize in developing advanced insurance software that improves efficiency, accuracy, and customer experience across the industry.

Agency/Broker Management

- Team Management

- Customer Management

- Policy Administration

- Analytics & Reporting

Claims Management Software

- Automated Claims Processing

- Monitoring & Audit Trails

- Digital Data Exchange

- Smart Claim Adjudication

Policy Management Systems

- Policy Management

- Quotation Automation

- Proposal Generation

- Reinsurance Solutions

Fraud Analysis Software

- Fraud Detection & Prevention

- Claims & Transaction Monitoring

- Proactive Alerts

- Vendor Screening & Risk Scoring

Risk Management Software

- Real-Time Data Insights

- Decision Support Alerts

- Comprehensive Risk Libraries

- Risk Reporting & Mitigation

Omnichannel CRM

- Lead & Prospect Management

- Opportunity Tracking

- Automated Claims Monitoring

- Agent & Broker Automation

- System Integration & Customization

Mobile for Insurance Adjusters

- Digital Signature Capture

- Claims Documentation Library

- Inspection & Assessment Forms

- Claims Settlement & Adjustments

Underwriting/Quoting Software

- Intelligent Underwriting

- Comprehensive Risk Evaluation

- Insightful Reporting

Documents Management Systems

- Digital Document Capture

- Policy & Form Management

- Centralized Document Repository

Integration Solutions for Modern Insurance Systems

We implement advanced tools and integrations to enhance InsurTech solutions, streamlining development and optimizing budgets.

Fraud Detection, KYC & AML

ERP

Document Management Systems

Insurance Management Software

CRM

Electronic Signature

Things You May Want to Know

Get insights into our Smart Insurance Automation

workflow.

What is insurance automation?

Insurance automation uses software to streamline repetitive tasks, reduce manual effort, and improve accuracy across underwriting, claims processing, policy management, and reporting.

How can automated workflows benefit my insurance business?

Automated workflows save time, minimize errors, ensure compliance, and enhance operational efficiency, allowing staff to focus on high-value tasks.

Which processes in insurance can be automated?

Key processes include claims lifecycle management, policy administration, agent and broker activities, client communication, document handling, and reporting.

How does automation improve claims management?

Automation enables real-time tracking, auto-adjudication, fraud detection, document management, and notifications, making claims faster and more accurate.

Can automation integrate with existing insurance systems?

Yes. Modern InsurTech software supports seamless integration with legacy systems, enabling enhanced functionality without disrupting current operations.

Will automation help in risk assessment and reporting?

Absolutely. Automated tools provide real-time data monitoring, risk scoring, reporting dashboards, and decision-making alerts to improve accuracy and reduce exposure.

Contact Us

Address

A7, 3d Floor, Sector 10

Noida, UP - 201301

Call Us

+91 8375951355

+91 8800939873

Email Us

info@sparkzont.com

support@sparkzont.com

Open Hours

Monday - Saturday

9:00AM - 07:00PM